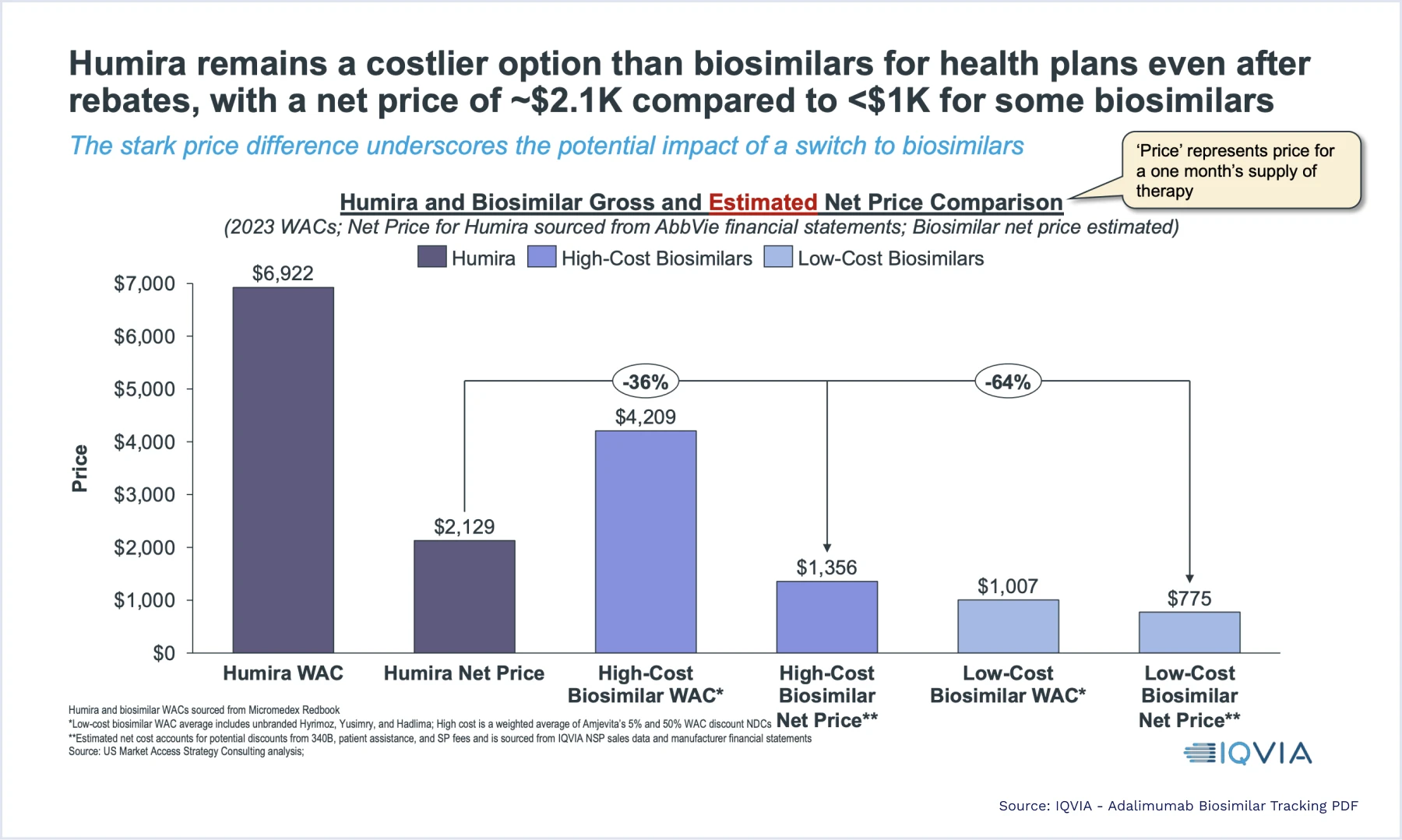

All these factors highlight how broader biosimilar adoption could have an immense impact on the pharmaceutical world. Shifts in formulary and rebate strategy will be common as benefit managers, health plans, and insurers seek savings while manufacturers pivot to evolving demand. While largest PBMs and health plans have the leverage to explore increased adoption, but the rest of the industry will face more complicated paths forward.

Sources:

1 Humira Exclusivity Expires in 2023: Will Biosimilar Boom Benefit Patients or Industry?

2 After a Year on the Market, Humira Biosimilars Aren’t Making Much of a Dent

3 CVS Caremark Accelerates Biosimilars Adoption Through Formulary Changes

4 Optum Rx Expands Choice Humira Biosimilars

6 CVS to Remove Humira from Some Reimbursement Lists in Favor of Biosimilar Options

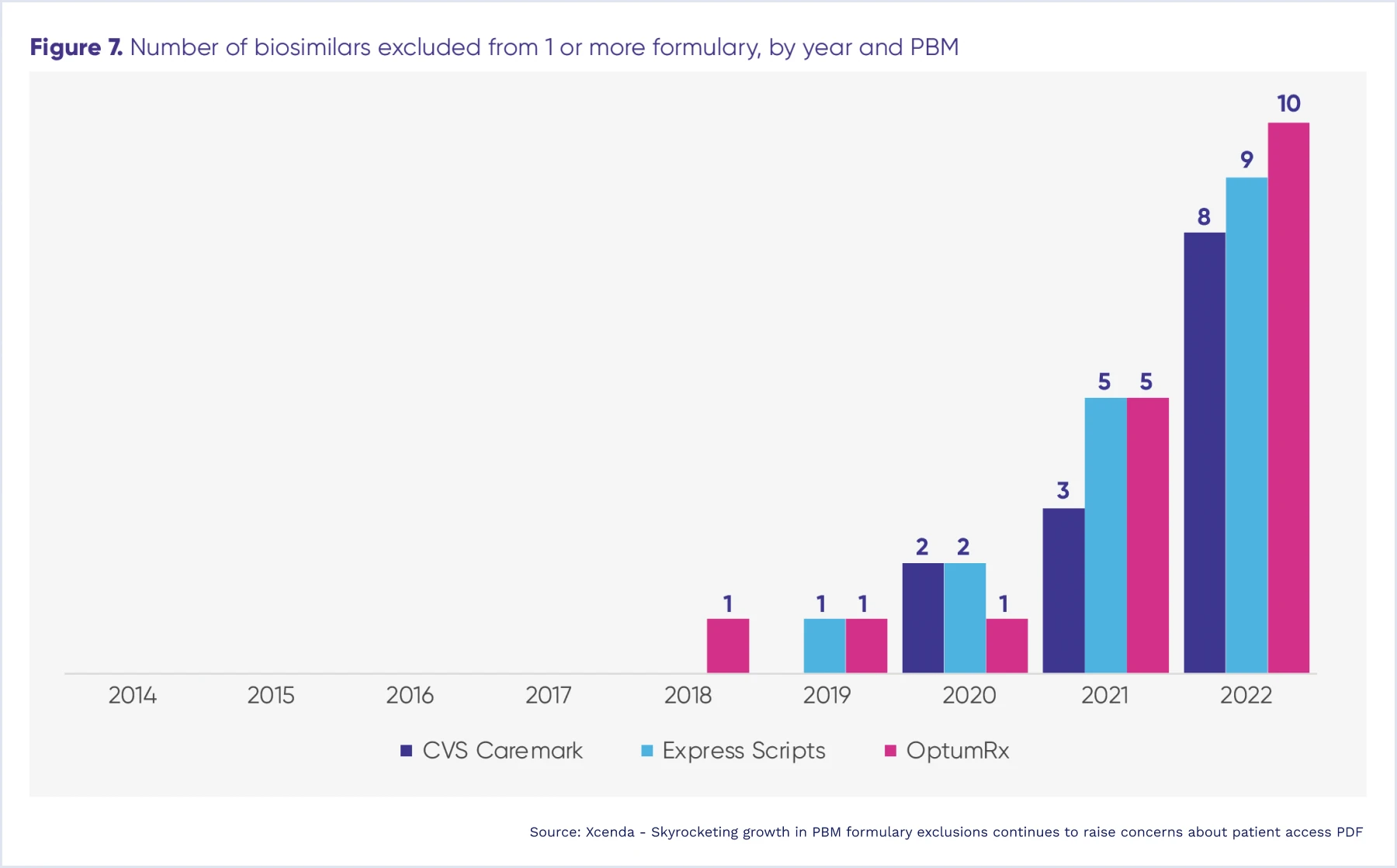

7 Skyrocketing growth in PBM formulary exclusions continues to raise concerns about patient access

8 Study Reveals Factors That Dissuade Commercial Plans from Covering Biosimilars